Two or three days which could reveal Mueller’s endgame

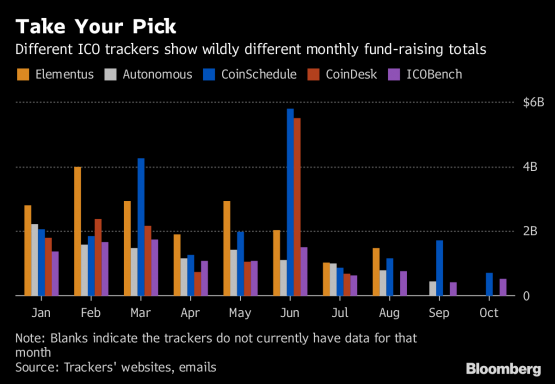

So far this season, initial coin offerings have risen $22 billion, or 50 % of that — dependant upon where you look.

With the cryptocurrency market nearly 80% off its peak, an essential question for you is exactly how much the ICO boom has deflated. That becomes harder to reply to when even usually used websites that track the phenomenon disagree about the figures.

Blockchain may very well be billed for immutable public ledger, nevertheless in the controversial whole world of crypto it spawned, establishing truth may be tricky when disclosure standards continue to be improvised daily. Regarding ICOs, it remains hard to ascertain the level of funds a issuer claims it’s raised when nobody should submit any regulated filings and even reveal their identities.

“At get rid of the time, there is not any way to really acknowledge the results based on provable facts,” said Alex Buelau, co-founder of Oxford, UK-based listing site CoinSchedule. “It’s early days. You think that just how do the business create a motivation for these guys to report accurate numbers? At this time there’s no incentive.”

Most data trackers, that make money from charging token sellers for listings and also other services, trust in issuers for information about the ICOs.

Take Ruby-X, a crypto exchange project. CoinSchedule says it raised $1.2 billion; ICORating, $200 million; Autonomous Research says it’s chosen to exclude it, since its online footprint was unreliable. Ruby-X, which hasn’t disclosed where it’s based, didn’t respond to e-mails seeking comment.

Or consider a extreme example: Venezuela’s sovereign Petro. In March, President Nicolas Maduro claimed it has garnered $5 billion in offers; in April, he said the sale raised $3.3 billion; the token’s website says $735 million, the figure cited by CoinSchedule and ICORating.

Even with all the best intentions, collecting basic facts about token sales may be a challenge. ICORatings combines information from issuers, investors and also the blockchain itself. Elementus, a whole new startup, tracks data in the blockchain, supplemented with reported figures so it considers credible.

With the capability to trace actual transactions, on-chain data are more reliable and comprehensive, which describes why their fund-raising totals are higher, says Elementus co-founder Nuria Gutierrez Prunera. But that on-chain data don’t capture investments in fiat currency.

Autonomous Research explains about 50 different underlying trackers to compile its ICO data and manually removes entries it considers untrustworthy, said Lex Sokolin, global director of fintech strategy. The trackers it all depends on have varied over time for their quality can fluctuate, possibly because economics of maintaining a database have weakened, he added.

To complicate things further, the character of ICOs is additionally evolving. An ever growing component of tokens can be found privately to selected investors, rather than crowdfunded online since the innovation was recognized for.

“It’s even more difficult to get out info about private sales,” said Sasha Kamshilov, co-founder of ICORating in St. Petersburg, Russia. “It’s essential for regular investors to recognise this price and types of conditions of the private sale.”

The Dragon token, which professes to give a payment system for your entertainment industry, told Bloomberg News in August so it raised $12 million within a public round and $408 million included in the private sale. For any sale, Elementus and CoinSchedule gave the $420 million total, ICORating had $3.9 million, whereas CoinDesk and Autonomous had $320 million.

Telling the correct story about crypto matters when debates over its future are raging amid the fading speculative frenzy. After Autonomous published research that showed token offerings were down 90% off their monthly peak in September, it received criticisms that that month actually saw a lot more than $1 billion of funds raised, rather than the $300 million it cited earlier.

“There’s always a modest amount of an improvement, however, if things were rising it didn’t matter within the edges,” said Sokolin at Autonomous. “Now that everything’s getting tight people desire to tell different stories.”

? 2018 Bloomberg L.P