Poland’s ruling party plays the LGBTQ card

The shift has been led by China, in which the economy’s weakest performance since 2009 is focused to worsen unless a peace could be struck within the trade war using the US Factory readings from Asia already show a fallout, with Taiwan, Thailand and Malaysia slipping into contraction territory.

The euro-area too is losing momentum, expanding during the third quarter at half the pace in the prior with three months as Italy and Germany stagnated. That comes just like inflation is choosing, generating complex 2019 for European Central Bank policy makers who’ve pledged to dial down monetary support.

The question for you is whether the US can resist the downdraft, providing ballast for the remainder of the globe. While a tightening labor market gives reason to hope it will, most economists forecast growth will ebb a lttle bit in 2019 within the back of protectionism, higher home interest rates as well as fading support of tax cuts.

“The story is the fact that we’re going to probably re-synchronise,” said Joachim Fels, global economic adviser at Pacific Investment Management. “But these times over the downside.”

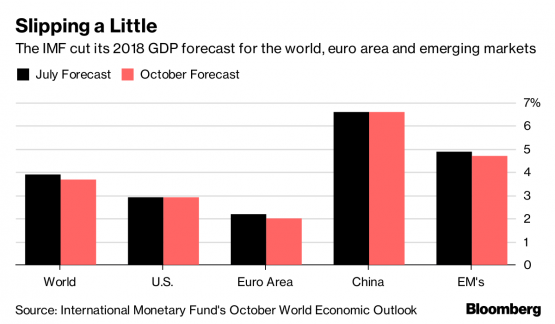

It’s reasonable turnaround from April, if your International Monetary Fund declared the entire world was experiencing the most united upswing since 2010. Its mood changed in October when cut its global outlook in my ballet shoes by 50 % numerous said growth had plateaued.

There are also other signs the height has gone by for the global economy. IHS Markit’s purchasing manager indexes for China and the euro area all retreated a few weeks ago to get the overall reading a great almost 2 year low, even though the US gauge was little changed. Most countries have seen their PMIs decline within the last with three months.

“The latest data strongly supports the view which the best days while in the post-2008 economic crisis growth cycle are considered,” said Alan Ruskin, global co-head of foreign-exchange research at Deutsche Bank AG.

A global reversal could add further jitters to stock markets and at last pressure central banks like the Federal Reserve to slow their exit from monetary stimulus, although to this point there’s scant sign the Fed is designed for turning.

What our economists say…

“Global growth started 2018 strong and convergent. Heading toward 2019, the strength in the US remains, for a lot of the other world it’s not necessarily. An integral question to the year ahead — how big the trade war drag as well as magnitude from the Chinese policy response. A simple yet effective stimulus from China would require a great number of the concern about global growth away from the table.”– Tom Orlik, chief economist, Bloomberg Economics.

Circuit breakers could have a breakthrough while in the trade dispute. Bloomberg reported on Friday that Trump needs to reach a package with Chinese President Xi Jinping later this month.

Other tonics could include a slower-than-expected pace of Fed rate hikes, that would also ease pressure on borrowers and emerging markets. As would a soothing of political tensions over Britain’s will leave european union or concerns about Italy’s huge debt pile.

The growth wobbles already have hit markets, as well as the moves are significant enough how they may have economic consequences. October marked on the list of worst months to the bull market in US stocks, causing selloffs around the globe that erased some $8 trillion in wealth.

A further 20% fall in global equity markets could lower average advanced economy gdp in 2019 and 2020, in line with a quote by Oxford Economics.

The US is definitely forecast to slow, with growth tipped for cooling to 2.7% in the fourth quarter, versus 3.5% in the third and 4.2% from the second, according to the median forecasts of economists tracked by Bloomberg.

“You can believe global growth is synchronising again ever since the usa is seeing growth decelerate,” said Megan Greene, chief economist at Manulife Asset Management. “This was absolutely to become expected as western world converged back toward their potential GDP growth rates.”

? 2018 Bloomberg L.P