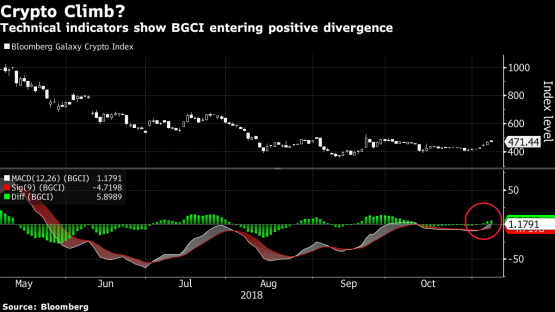

Crypto bulls receive a green light on potential year-end rally

A technical indicator for the index tracking most of the largest digital currencies suggests the crypto industry could be poised to destroy out from its recent malaise and rally at year end.

The MACD, or moving average convergence divergence, gauge with the Bloomberg Galaxy Crypto Index entered its first positive divergence in a month. The move corresponds with an upward trend in bitcoin, helping to make up around 30% of the fund. Bitcoin has risen to the seventh-straight day and is also at its highest level into two weeks, hovering around $6 500.

Long-term trend lines in bitcoin’s Directional Movement Index (DMI) also showed a digital token entering the latest bullish phase in the week.

“The technicals look great as well as fundamentals are great,” said Mati Greenspan, senior market analyst at eToro, in an email. “All signs are going to some Father christmas rally inside crypto market.”

XRP, the cryptocurrency often called ripple as well as index’s third-largest member, also moved higher today, rallying nearly 10% since Monday on news than a crypto exchange may list XRP on its trading platform.

But bitcoin together with other cryptocurrencies were volatile throughout the year along with the recent moves don’t excite everyone. Bitcoin really should be worth half its recent value, dependant on volume trends and historical pricing, wrote Bloomberg Intelligence analyst Mike McGlone within a note. “Wish them luck, but many in our indicators remain negative,” he stated.

? 2018 Bloomberg L.P