Nasdaq expects flurry of Nordic listings in final months of the year

Nasdaq expects listings activity on its Nordic stock markets to receive inside final 2 months on this year, after market volatility concluded in a big slowdown inside lover.

Nasdaq’s Nordic main market and alternative First North platform for smaller publication rack en route to “somewhere around a hundred” listings this current year, Nasdaq Nordic President Lauri Rosendahl said in a interview in Stockholm. That has a total of 66 listings up to now this coming year, it means there is certainly scope for over 30 additional ones in November and December.

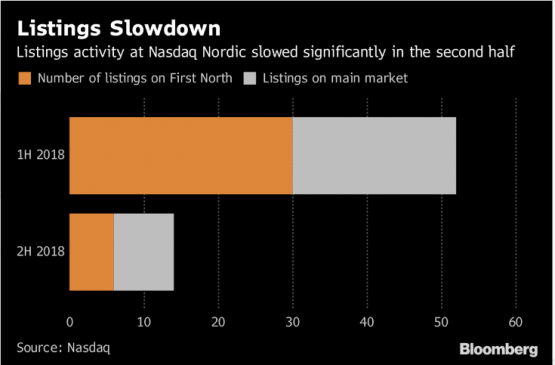

That should bring the 2010 total to about identical level as in 2015 and 2016, even though it would be underneath the record 115 seen last year. Specifically that to occur, there must be a flurry of listings this month and then. For the sheer number of initial public offerings, moves on the main market and spinoffs slowed to just 14 within the loved one to date, from 52 within the first half.

“You will discover a great pipeline for IPOs, particularly numerous small medium-sized companies,” Rosendahl said, adding that the outlook for 2019 is “promising” in the process. “And now we are hopeful that, if markets unwind, we’ll identify that pipeline in the years ahead toward public market listings,” he said.

Stock debuts thus far in 2010 on Nasdaq’s stock exchanges in Sweden, Finland, Denmark and Iceland include the initial public offering of Iceland’s Arion Banki hf in Reykjavik and Stockholm, and Autoliv’s directory Veoneer inside Swedish capital. That’s also where Atlas Copco listed its Epiroc unit because it split the company by two. But there was clearly also plans that fell through.

Volvo Cars at the beginning of September delayed its planned IPO due to threat of global trade tensions growing more serious. The Swedish automaker’s boss, Hakan Samuelsson, said then the timing for the share sale was no longer optimal because market conditions had turned unpredictable. In Helsinki, Restamax Oyj’s spinoff of staff rental subsidiary Smile Henkilostopalvelut Oy was aborted last month.

While investor uncertainty has increased while in the wake from the recent market volatility and concerns concerning the global macroeconomic prospects, Rosendahl said the outlook for that Nordic region “still looks very promising.” It could possibly simply be that investing arenas are now entering a far more normal amount of volatility if you do unusually calm years, he was quoted saying.

But there are risks, stemming from your growth outlook and central banks now moving to undo numerous easing, he stated. Sweden’s Riksbank has stated it offers to start raising the repo rate in my ballet shoes in more than seven years in December or February.

“The biggest risk towards stock markets will be the question of boost in the other 2-3 years with the apr level that we’ll have,” Rosendahl said.

? 2018 Bloomberg L.P