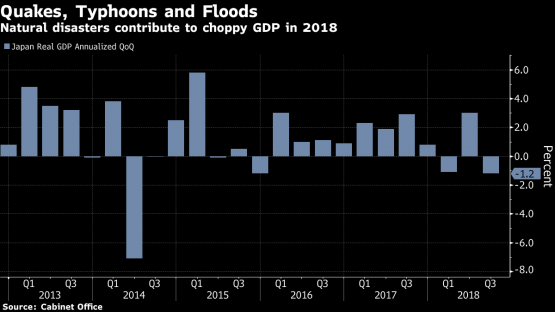

Japan’s economy shrinks for second amount of 2018 after disasters

Japan’s economy shrank for the second time this year after an earthquake, typhoons and torrential rain battered production both at home and exports declined amid softer demand overseas.

Gross domestic strategy is forecast to get better from your annualised 1.2% stop by the final quarter, and also to continue growing until a sales-tax hike in October 2019, nonetheless the impact of your slowdown in China and trade tensions will keep your expansion modest.

Reports that President Donald Trump holds off in the meantime on imposing tariffs on imported Japanese cars and auto parts keeps among the list of largest threats to Japan’s economy from exploding for now.

The wild weather that passed through regions including Osaka and Tokyo, plus an earthquake to the northern island of Hokkaido, knocked out power supplies, halted factories and disrupted supply chains. Exports suffered the best decline in additional than 36 months.

Yet the falloff across a range of economic activities can’t simply be explained by natural disasters, said Kyohei Morita, chief Japan economist at Credit Agricole Securities Asia. “The trade war and China’s slowdown were noticed that you please take a toll on Japan’s economic growth,” he stated.

Masaki Kuwahara, senior economist at Nomura Securities, said about 1 percentage reason for the 1.8% decline in exports was because of the disasters, with the remainder the slowdown in China.

The patchier growth is unwelcome news for Pm Shinzo Abe, who last month confirmed which the florida sales tax hike would try pick up considering the strength in the economy. The third-quarter figures don’t warrant any change obviously for Abe additionally, the Bank of Japan, based on economists.

The BOJ is in a great spot by incorporating people thinking it ought to raise rates to help alleviate pressure within the profits of regional banks and limit risks towards overall economy, said Takeshi Minami, chief economist at Norinchukin Research Institute. “The main problem is did it really raise rates when the economy is losing momentum?” he was quoted saying.

What our economist says …

“Japan’s economy was required to go on a hit with a string of disasters that disrupted production in 3Q, when the GDP data bore out. The great news is that your effects will pass, plus a rebound in 4Q is probably. The negatives inside the data were discouraging, though not alarming.” — Yuki Masujima, Bloomberg.

Business spending, which had been anticipated to slow after its 3.1% boost in the other quarter, edged down 0.2% for any first drop in eight quarters.

Private consumption, another driver on the rebound from the second quarter, slipped 0.1%.

On a non-annualised basis, the quarter-on-quarter drop in GDP was 0.3%.

? 2018 Bloomberg L.P